1. Property Search

The Sucasa team focuses on higher value neighborhoods with good resale prospects for lower financial risk. We target existing buildings that either need minimal/quick rehab work for fast turnover, or buildings that require more intensive (gut) rehab but have significant upside.

2. Evaluation

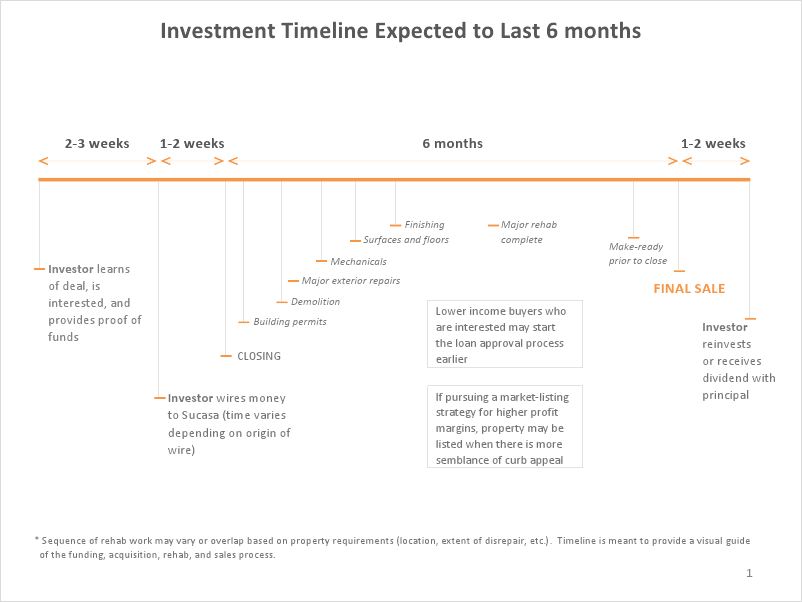

Sucasa uses conservative financial projections and healthy budgets with contingencies. Fast moving projects are targeted for completion within 180 days, while more intensive projects may take up to 12 months. Any partners involved with Sucasa are subject to strict financial standards.

3. Investor Outreach

After shortlisting projects with the highest likelihood of closing, Sucasa reaches out to investors for financing. Sucasa offers its investors complete financial transparency and risk assessments so that they can make an educated decision.

4. Project Management

Sucasa works closely with its partners and contractors throughout a project. We conduct regular property inspections to ensure projects are on schedule. Incremental payouts are made only after completion of tasks. Investors are regularly updated on the rehab and marketing process.

FAQ

(1) How does Sucasa and its business partners find the deals?

Sucasa and its business partners aim to purchase properties below market value, ensuring some equity buffer for the investor. Sources include bank portfolios, MLS listings, wholesalers, and auctions.

(2) How do you ensure the properties are sold?

Properties are only considered if they are located in the better neighborhoods/townships of the Chicagoland area of Illinois for more curb appeal.

Properties are also sold just below market value to ensure rapid turnover. This also provides added incentive (instant equity) for prospective home-owners. In the event that our lower-income buyers are unable to secure financing, our properties can still be sold on the market although the sales process may take longer.

Properties are also sold just below market value to ensure rapid turnover. This also provides added incentive (instant equity) for prospective home-owners. In the event that our lower-income buyers are unable to secure financing, our properties can still be sold on the market although the sales process may take longer.

(3) How do you know what a property is worth?

Properties are valued by licensed appraisers using comps (listings of comparable recently sold properties), or licensed real estate brokers using a Broker’s Price Opinion (BPO). These numbers provide a reliable indicator for us to set our benchmarks for ARV (after-repair-value). We use conservative estimates in our financial projections to discount the investment property value as well.

(4) What if the project doesn't work out, can I get my money back?

While we can never predict the future, in the event that the project ends due to unforeseen circumstances (natural disasters, severe building structural issues deemed too expensive to correct, unexpected regulatory delays that push project timelines too far out, etc.), Sucasa will return the principal loan to the investor. By having adequate insurance, possible equity buffer at purchase and sourcing in the more sought-after neighborhoods of Chicago, we are confident in our properties holding value at or above the initial investment. The process may take several months since the property has to be liquidated in accordance with Illinois state law.

(5) Who holds title to the property during the project?

Sucasa will hold title to the property and be the sole owner on record.

(6) If there are multiple investors in a project, will there be a bias?

No. Every investor in a project regardless of their contribution will receive their fair share at a predetermined rate. Once an investor has committed to the project, they are required to stay committed for the entire loan period and may not influence the project’s construction or sales process.

(7) How many projects can you handle at a time?

Sucasa maintains connections to a large crew of contractors and service professionals and can comfortably handle up to 6 projects at any one time. If there are lucrative projects and available financing, Sucasa will consider expanding its crew after appropriate vetting of their qualifications.

(8) I'm interested. How do I get started?

Sucasa will present a portfolio of possible investment property options for you and find the one that best fits your needs, schedule and expected returns. If no projects are immediately available, you will be added to our contact list and Sucasa will contact you once a suitable property is found.

(9) Are you licensed for real estate?

The principal of Sucasa, Kok Keng Goh, is a licensed Real Estate Broker with Ask Nagel Realty located in Chicago, IL, and abides by all applicable Equal Housing Opportunity laws. All material presented herein is intended for informational purposes only, is compiled from sources deemed reliable, but is subject to errors, omissions, and changes without notice. Nothing herein shall be construed as legal, accounting, or other professional advice outside the realm of Real Estate Brokerage.